In a world filled with various investment options—from stocks and bonds to cryptocurrencies and mutual funds—real estate remains one of the most trusted and rewarding investment choices. Known for its stability and potential for long-term growth, real estate has proven to be a resilient investment through market fluctuations, economic downturns, and shifting financial trends. Here’s a closer look at why real estate continues to stand out as a smart, reliable choice for investors today.

1. Tangible Asset with Inherent Value

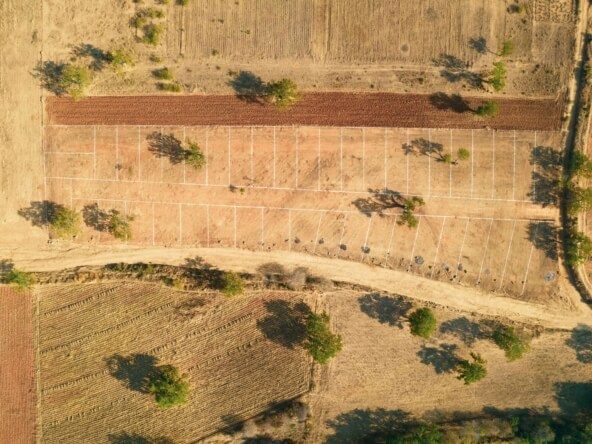

Unlike stocks or other intangible investments, real estate is a physical, tangible asset. Whether it’s a piece of land, a residential property, or a commercial building, real estate has an inherent value that typically doesn’t depreciate. While market prices may fluctuate, the physical property remains a valuable asset, offering both security and stability. This tangible nature of real estate makes it a more grounded investment, which many investors find comforting, especially during volatile times.

2. Steady Cash Flow and Passive Income

Real estate investments can generate a consistent cash flow through rental income, making it an ideal choice for those looking to build a source of passive income. When managed well, rental properties can provide monthly returns that cover mortgage payments, property maintenance, and even leave a profit. Commercial properties, multifamily housing, and short-term rentals are particularly popular among investors seeking steady cash flow, as demand for rental properties remains high in many areas.

3. Long-Term Appreciation Potential

Over time, real estate typically appreciates in value, meaning it’s likely to be worth more in the future than it is today. Historical trends show that real estate, especially in high-demand locations, appreciates steadily over the years. This potential for long-term appreciation makes real estate a wise investment for those looking to build wealth gradually. Real estate’s appreciation also outpaces inflation, meaning your investment’s value increases, even as the cost of living rises.

4. Tax Advantages and Incentives

Real estate investors benefit from a range of tax advantages that make it a highly efficient way to build wealth. For example, you can deduct expenses related to mortgage interest, property taxes, operating expenses, and even depreciation. Additionally, real estate investors may take advantage of tax-deferred exchanges, which allow you to roll profits from one property into another without immediate tax liability. These benefits can enhance your overall return on investment and make real estate more attractive than other, fully taxable investments.

5. Leverage and Financial Flexibility

Real estate offers the unique advantage of leverage, allowing investors to buy property with a small portion of their own money and finance the rest. This means you can control a large, valuable asset with minimal upfront capital, amplifying your potential returns. As the property appreciates and generates income, you’re effectively using borrowed money to grow your investment portfolio. Real estate also provides the flexibility to refinance or use the equity you’ve built in the property to fund other investments or financial needs.

6. Portfolio Diversification

Real estate is an excellent way to diversify an investment portfolio, especially if most of your assets are in volatile markets like stocks or bonds. Real estate typically doesn’t follow the same ups and downs as other markets, making it a solid way to balance risk. When other markets are down, real estate often holds its value, providing a hedge against market volatility. This diversification is essential for minimizing risk and increasing the overall resilience of your investment portfolio.

7. Ability to Improve and Add Value

One of the unique aspects of real estate is that you have the power to improve your investment and directly increase its value. Renovations, upgrades, and smart property management can all boost the property’s worth and rental income potential. Unlike stocks, which investors can only passively own, real estate provides opportunities for active involvement, making it a dynamic asset that grows with effort and smart planning.

8. Stability in Economic Downturns

While no investment is entirely immune to economic downturns, real estate tends to hold its value better than many other assets during recessions or market crashes. People will always need housing, which creates a stable demand for residential properties even in difficult economic times. Commercial properties in prime locations can also retain tenants and income streams, making real estate an attractive option when economic conditions are uncertain.

Conclusion

Real estate remains one of the smartest investment choices due to its stability, long-term growth potential, and ability to generate passive income. It provides investors with tangible value, tax benefits, and the opportunity for leverage and portfolio diversification. While other investments come and go with market trends, real estate has stood the test of time, providing lasting wealth and financial security. Whether you’re a seasoned investor or a first-time buyer, investing in real estate is a sound strategy for building a secure financial future.